The Regulatory Revolution: Five Critical Market Developments

1. China’s Historic Food Safety Standards Overhaul

China has unleashed the most comprehensive food safety regulatory update in recent history, releasing 50 new or updated national food safety standards throughout 2025 4 5. This regulatory blitz encompasses food labelling, additives, contaminants, food contact materials, and microbial testing methods, fundamentally reshaping market access requirements for the world’s second-largest economy.

Key developments include:

- Enhanced Labelling Requirements: The new GB 7718-2025 standard introduces mandatory allergen labelling, digital label provisions, and stricter ingredient disclosure requirements, taking effect March 16, 2027 6 7

- Additive Standards Revolution: GB 2760-2024, implemented February 8, 2025, significantly restricts dehydroacetic acid usage across multiple food categories, including bread, pastries, and processed meats 8 9

- Food Contact Material Controls: Five new testing standards for food contact materials, including enhanced migration testing for phthalates and nitrosamines, became effective September 16, 2025 10 11

Strategic Implications for Malaysian Exporters

Malaysian manufacturers exporting processed foods, confectionery, and packaged goods to China must immediately audit their formulations against the new additive restrictions. The allergen labelling requirements particularly impact Malaysian producers of products containing nuts, dairy, or gluten-containing ingredients. Food contact material suppliers must upgrade their testing protocols to meet the enhanced migration standards.

Companies should prioritise establishing relationships with China-based regulatory consultants and consider investing in Chinese-language labelling capabilities to ensure compliance with the digital label requirements. The two-year implementation timeline for GB 7718-2025 provides a strategic window for systematic compliance preparation.

2. European Union’s Precision Contaminant Control Initiative

The European Union has implemented its most targeted contaminant control measures to date through EU Regulation 2023/915, establishing unprecedented precision in food safety management. The regulation introduces specific maximum levels for nickel across 16 food categories and enhanced mycotoxin standards, reflecting the EU’s commitment to evidence-based risk management 12 13.

Critical Implementation Details:

- Nickel Limits: Maximum levels range from 0.4 mg/kg for fruiting vegetables to 40 mg/kg for wakame seaweed, with most limits effective July 1, 2025 14 15

- Cereals Exception: Cereal products receive a one-year implementation extension until July 1, 2026, acknowledging supply chain complexities 16 17

- Enhanced Mycotoxin Standards: Updated limits for ochratoxin A, deoxynivalenol, and T-2/HT-2 toxins across cereals and processed products 18 19

Malaysian Export Strategy Considerations

Malaysian exporters of palm oil-based products, tropical nuts, and cocoa derivatives face immediate compliance requirements. The nickel limits particularly impact cashew nuts (3.5 mg/kg limit), cocoa powder (3.0 mg/kg), and chocolate products, which represent significant Malaysian export categories to the EU market.

Manufacturers should immediately initiate nickel testing protocols for affected products and consider supply chain modifications to source raw materials from lower-nickel regions. The differential implementation timeline for cereals provides strategic planning opportunities for companies with diversified product portfolios.

3. Thailand’s Targeted Additive Contamination Controls

Thailand has pioneered a highly specific approach to additive safety through new contamination limits for ethylene glycol (EG) and diethylene glycol (DEG) in 12 high-risk food additives, effective October 2025 20 21. This regulation addresses global health incidents linked to these toxic compounds in pharmaceutical and food applications.

Regulatory Specifications:

- Scope: Covers sorbitol, glycerol, propylene glycol, maltitol, and various polyoxyethylene compounds 22

- Limits: Maximum 0.10% for most additives, with 0.25% combined limit for polyoxyethylene sorbitan compounds 23

- Implementation: 90-day transition period following Royal Gazette publication 24

Impact on Malaysian Suppliers

Malaysian chemical and additive manufacturers serving the ASEAN market must immediately verify their production processes to ensure EG/DEG contamination levels comply with the new standards. This particularly affects companies producing food-grade glycols, sugar alcohols, and emulsifiers for regional distribution.

The regulation’s alignment with Codex Advisory Specifications suggests potential adoption by other ASEAN members, making early compliance a competitive advantage for Malaysian suppliers targeting regional expansion.

4. India’s Sustainable Packaging Revolution

India’s Food Safety and Standards Authority (FSSAI) has revolutionised food packaging regulations through the Food Safety and Standards (Packaging) First Amendment Regulations, 2025, effective March 28, 2025 25 26. This landmark change permits recycled polyethylene terephthalate (PET) in food packaging while maintaining stringent safety standards.

Revolutionary Changes Include:

- Recycled Plastic Authorisation: First-time approval for recycled PET in food contact applications 27 28

- Traceability Requirements: Mandatory labelling of recycled content and supply chain documentation 29

- Enhanced Testing Standards: Upgraded migration testing and certification requirements 30

- Critical Status Elevation: Food packaging materials reclassified as “critical” in inspection protocols 31

Malaysian Market Opportunities

This regulatory shift creates significant opportunities for Malaysian packaging manufacturers to develop sustainable solutions for the Indian market. Companies with recycling capabilities can leverage this regulatory change to establish market leadership in eco-friendly food packaging.

Malaysian food exporters to India must ensure their packaging suppliers meet the new recycled content labelling and traceability requirements. The regulation’s emphasis on sustainability aligns with global consumer trends, potentially providing competitive advantages for early adopters.

5. Australia/New Zealand’s Fresh Produce Safety Intensification

Food Standards Australia New Zealand (FSANZ) has implemented comprehensive primary production and processing standards for berries, leafy vegetables, and melons, effective February 12, 2025 32 33. These standards represent the most significant expansion of mandatory food safety requirements in the region’s fresh produce sector.

Comprehensive Requirements Include:

- Registration Mandates: All producers and processors must register with local government authorities 34 35

- Food Safety Management: Mandatory food safety management statements for non-certified businesses 36 37

- Traceability Systems: Complete supply chain tracking from growing site to wholesale distribution 37

- Enhanced Hygiene Protocols: Upgraded sanitation, water quality, and temperature control requirements 37

Malaysian Fresh Produce Export Implications

Malaysian tropical fruit exporters, particularly those supplying berries and melons to Australian and New Zealand markets, must immediately assess their production systems against the new standards. While Malaysia’s tropical fruit exports may not directly compete with the covered commodities, the precedent suggests potential expansion to other fresh produce categories.

Companies should proactively implement food safety management systems that exceed current requirements, positioning themselves advantageously for potential standard expansions and demonstrating commitment to international best practices.

Strategic Response Framework for Malaysian Exporters

Immediate Action Priorities (Next 90 Days)

- Compliance Assessment and Gap Analysis: Conduct audits to verify compliance with new global regulations on food additives, contaminants, and packaging.

- Supply Chain Resilience Building: Diversify suppliers to ensure market access despite regulatory changes. Identify alternative raw materials, establish compliant packaging, and develop redundant supply chains.

- Documentation and Traceability Enhancement: Upgrade documentation to meet global traceability requirements. Implement digital tracking, maintain sourcing records, and establish audit trails.

Medium-Term Strategic Positioning (6-12 Months)

- Technology Investment and Capability Building: Invest in testing capabilities to verify compliance with new global contaminant limits, including nickel and EG/DEG monitoring.

- Regulatory Intelligence and Market Monitoring: Invest in regulatory monitoring – subscribe to databases, join industry groups, and work with consultants to stay ahead of global food safety changes.

- Product Innovation and Differentiation: Leverage regulatory changes to develop premium, safety-certified products that exceed new requirements and appeal to safety-conscious consumers.

Long-Term Competitive Advantage Development

- Market Leadership Through Compliance Excellence: Malaysian exporters should position themselves as regional leaders in food safety compliance. This includes obtaining voluntary certifications, participating in global initiatives, and sharing best practices.

- Strategic Market Diversification: Malaysian companies should explore emerging markets with developing regulations where their compliance expertise provides advantages. This includes expanding into Africa and South America while building future-ready capabilities.

- Innovation Ecosystem Development: Malaysian companies should collaborate with experts to develop next-gen compliance solutions, including industry consortiums, regulatory research, and food safety tech.

The auRELIA Advantage: Transforming Compliance Challenges into Competitive Opportunities

The complex regulatory landscape of 2025 presents both unprecedented challenges and strategic opportunities for Malaysian food and beverage exporters. While manual compliance management becomes increasingly untenable given the pace and complexity of global regulatory changes, intelligent automation offers a pathway to transform compliance from a cost center into a competitive advantage.

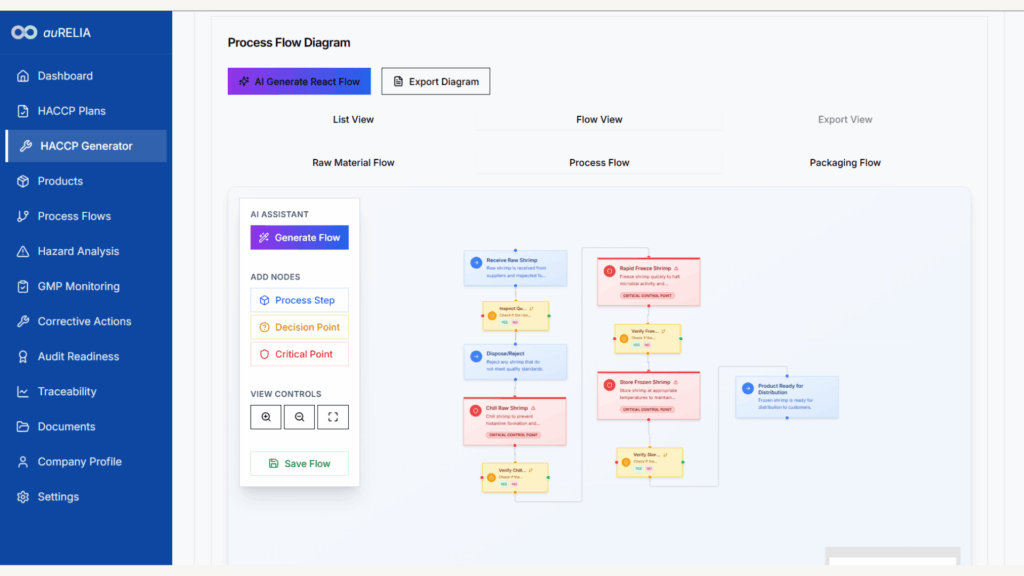

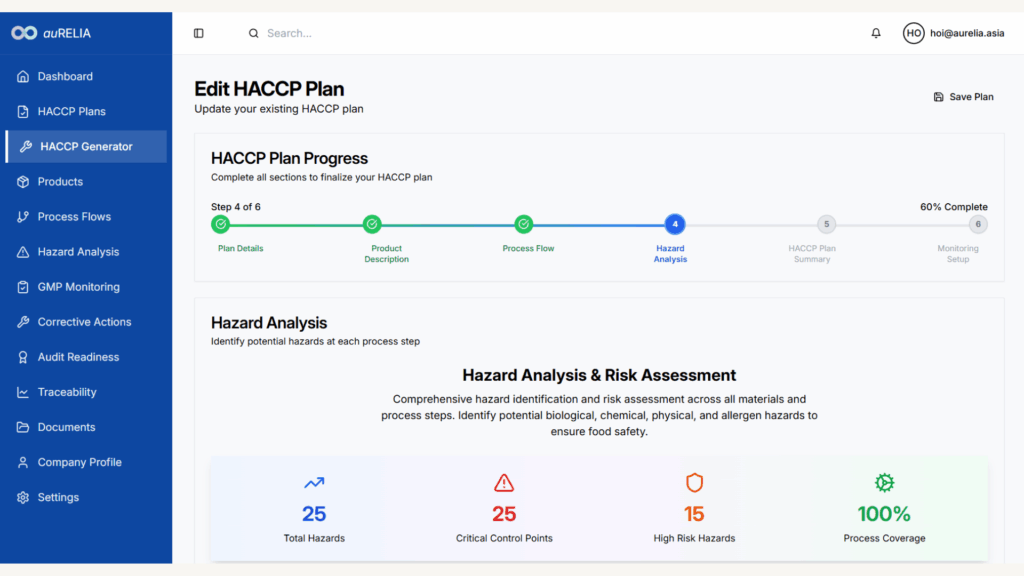

auRELIA’s Smart HACCP Automation platform directly addresses the compliance challenges identified in this analysis. Our AI-powered system generates HACCP plans aligned with both Malaysian MS1480 standards and international requirements, ensuring Malaysian exporters meet the evolving demands of global markets while maintaining operational efficiency.

For the China market, auRELIA’s system can automatically incorporate the new GB standard requirements into HACCP documentation, ensuring compliance with enhanced labelling and additive regulations. For EU exports, our platform generates hazard analyses that specifically address nickel contamination risks and mycotoxin control measures. For regional ASEAN markets, auRELIA ensures compliance with Thailand’s new additive contamination limits and supports expansion across multiple regulatory frameworks.

The platform’s collaborative approach means Malaysian exporters can work seamlessly with international consultants to verify compliance with specific market requirements while maintaining centralised control over their food safety management systems. This becomes particularly valuable when managing compliance across multiple export destinations with varying regulatory requirements.

Join auRELIA’s Pilot Program

Position your company at the forefront of intelligent compliance management. As regulatory complexity intensifies globally, early adoption of automated HACCP systems provides strategic advantages that compound over time. Our pilot program offers exclusive access to cutting-edge compliance technology specifically designed for the challenges facing Malaysian exporters in 2025 and beyond.

Register for our pilot program to experience firsthand how intelligent automation can transform your compliance operations from reactive burden to proactive competitive advantage:

Connect With Our Founders

Ready to transform your HACCP compliance process? Connect directly with auRELIA’s leadership team:

Ms. Christin Theresa Lim, CEO

Co-founder of auRELIA Insights, specialising in food safety and regulatory compliance for Southeast Asian markets. Her expertise helps businesses navigate complex international standards and ensure seamless market access.

Mr. Arvindran Salyah, COO

Co-founder of auRELIA Insights, bringing extensive experience in market access, financial and operational advisory for agri-business, food and beverage companies. He focuses on sustainable growth and compliance efficiency.

auRELIA Insights is backed by Antler and founded by leaders driving the future of work at the intersection of people and technology. Ready to get export-ready faster? Let’s make compliance work for you—not against you.